omega hedge fund Leon Cooperman is closing his hedge fund, Omega Advisors, and converting it into a family office because he does not want to spend the rest of . Learn how to play Red Mage, a magical ranged DPS job in Final Fantasy XIV that casts spells to generate mana that they channel into their rapier to unleash powerful melee combos with strong finisher spells. Red Mage can be unlocked in Ul'dah after reaching level 50 and owning the Stormblood expansion.

0 · omega funds team

1 · omega funds products

2 · omega funds portfolio

3 · omega funds news

4 · omega funds investment

5 · omega funds company

6 · omega fund recovery firm

7 · omega fund management

You get the lvl 50 relic weapon from a dude in north shroud. The lvl 50 AF weapons are part of a questline to rebuild weapons of legend, which the beginning quest is found in Vesper Bay, Western Thanalan, given by Nedrick Ironheart. You don’t get an artifact weapon; the job quests just give you armor.

Leon Cooperman (Trades, Portfolio)'s Omega Advisors has strategically expanded its portfolio by adding five new stocks in the third quarter of 2023. Noteworthy among these .

Leon Cooperman is shutting down his hedge fund firm, Omega Advisors, and returning all capital to investors at year end, according to a . Cooperman founded Omega Advisors in 1991, a hedge fund known for strong performance; he shut down the fund at the end of 2018. Leon Cooperman is closing his hedge fund, Omega Advisors, and converting it into a family office because he does not want to spend the rest of . Billionaire hedge-fund manager Leon Cooperman is returning outside investor capital at year-end. Omega Advisors is converting to a family office at the end of 2018, .

Veteran hedge-fund manager Leon Cooperman is planning to change the Omega fund into a family office, a move that has become more common in recent years. Omega Advisors is an NYC-based hedge fund that was launched back in 1991 by now renowned investor and billionaire, Leon Cooperman. The fund utilizes a long/short .

Omega Advisors has disclosed 52 total holdings in their latest 13F filing with the SEC for the portfolio date of 2024-06-30. The current portfolio value is calculated to be .37 . LONDON (Reuters) - American billionaire Leon Cooperman said in a letter to investors seen by Reuters that he plans to close his Omega Advisors hedge fund firm and .

the information on this site is intended for the management of companies interested in partnering with omega funds. it is not appropriate for any current or prospective investors in an omega investment vehicle and should not be .

The hedge fund manager told investors that he plans to convert his Omega Advisors at year-end into a family office, managing his own money rather than that of other investors. Introducing Omega: our hedge fund in a box. Let's level the playing field. Here's how. 👇 My business partner at Quant Science, Jason Strimpel, just shared an internal demo on version 0.3 of .The Alpha and Omega of Hedge Fund Performance Measurement February 2003 Noël Amenc Professor of Finance, EDHEC Graduate School of Business Head of Research, Misys Asset Management Systems Lionel Martellini Assistant Professor of Finance, Marshall School of Business Abstract The fact that hedge funds are starting to gain wide acceptance while they .

Omega Advisors is a hedge fund managing ,372,950,123 for 7 clients. Their Q1 2024 13F filing reported ,400,310,570 in managed 13F securities, with a top 10 holdings concentration of 61.09%.Omega’s hedge fund cybersecurity, compliance and cloud services are innovative, flexible and backed by our 24×7 customer-first approach that prioritizes accessibility and responsiveness. Managed IT Support . 24×7 access to best-in-class Service . Omega Advisors , current and past portfolio holdings. The SEC filings include form N-PORT and form N-PORT/A, which are filed by registered management investment companies and exchange-traded funds (ETFs) organized as Unit Investment Trusts. . Cooperman converted his hedge fund into a family office in 2018. Leon Cooperman Investing Philosophy . New York-based Omega Advisors has been in business since 1991, making it one of the longest-running hedge funds in operation today. Even more impressive is its performance over those 24 years: Its .

Cooperman founded Omega Advisors in 1991, a hedge fund known for strong performance; he shut down the fund at the end of 2018. In 2017, Cooperman settled SEC insider trading charges by paying .9 . Omega Systems, a managed service provider to the hedge funds industry, has acquired Amnet Technology Solutions and Cloudpath, providing clients of both firms with access to Omega's portfolio of managed IT, cybersecurity and regulatory compliance services.Omega ratio. The omega ratio is a risk-return measure, like the Sharpe ratio, that helps investors to assess the attractiveness of a hedge fund, mutual fund, or individual security.But unlike the Sharpe ratio, which only takes into account the volatility, the omega ratio also considers the so-called higher moments of the distribution.We’re pleased to share that Omega Systems received the Best Managed IT Service Provider award at the prestigious 2023 HFM US Services Awards in New York.. Recognizing providers “who have demonstrated exceptional client service, product development and strong and sustainable business growth”, the annual HFM awards honor the top hedge fund service .

About Omega Capital. Omega Capital is a private equity firm headquartered in Tulsa, Oklahoma. Its inaugural fund, Omega Capital Fund I, L.P., closed in April 2014 with million in commitments. Omega Capital Fund II, L.P. held a first closing in July 2024. The firm is backed by some of the most prominent entrepreneurs and family offices in .Two Sigma's scientists bring rigorous inquiry, data analysis, and invention to help solve the toughest challenges across financial services.

Leon Cooperman set up his hedge fund Omega Advisors in 1991. He would spend the next 17 years of his life managing capital for outside investors and then retire and convert the fund into a family .Introduced in 2002 by Keating and Shadwick, the Omega ratio is a relatively new addition in a hedge fund metrics library. By employing higher moments and taking into account actual shapes of distributions of returns, this measure is . LONDON (Reuters) - American billionaire Leon Cooperman said in a letter to investors seen by Reuters that he plans to close his Omega Advisors hedge fund firm and give investors their money back . As a measure of attractiveness, omega can be used for performance measurement but also for optimal asset allocation. This paper sets first the theoretical foundations for using omega in the investment decision problem. Then, the measure is applied to optimal asset allocation for portfolios containing hedge fund indices.

・After a 24-year-long career at Goldman Sachs, he founded his hedge fund Omega Advisors in 1991. ・The fund almost always outperformed the S&P 500 Index reaching an average annual gain of 12.5%.

omega funds team

Omega Flex Trading Up 1.4 %. Shares of NASDAQ:OFLX opened at .35 on Tuesday. The business has a 50 day moving average of .12 and a two-hundred day moving average of .91. Omega Flex, Inc .Introduced in 2002 by Keating and Shadwick, the Omega ratio is a relatively new addition in a hedge fund metrics library. By employing higher moments and taking into account actual shapes of distributions of returns, this measure is well-suited for hedge fund risk assessment, because of the non-normality of their distributions.

He founded Omega Advisors in 1991 which had around B in AUM at the peak. In 2018, the hedge fund was converted to a family office structure. Leon Cooperman is a value investor who tends to place . He left the firm after 25 years and founded Omega Advisors, a .4 billion hedge fund based in New York City. In 2018, Leon Cooperman converted Omega Advisors to a family office. An early riser .The Alpha and Omega of Hedge Fund Performance Measurement Noël Amenc, Susan Curtis and Lionel Martellini¤ February 27, 2003 Abstract That hedge funds start gaining wide acceptance while they still remain a somewhat mysterious asset class enhances the need for a better measurement of their performance.

Cooperman Leon G is a hedge fund with 7 clients and discretionary assets under management (AUM) of ,372,950,123 (Form ADV from 2018-03-29). Their last reported 13F filing for Q2 2024 included ,369,946,941 in managed 13F securities and a top 10 holdings concentration of 60.94%. Cooperman Leon G's largest holding is Mr Cooper Group Inc with .

Typical Omega Functions for (a) the S&P500, (b) Eurekahedge North American long/Short Equities Hedge Fund Index and (c) US Long/Short Equity Hedge Fund, Over Jan 2000 to Dec 2011 for ComparisonHedge Fund Portfolio Manager Performance 24Q2 AUM # of Holdings Performance Rank Allocation ; Omega Fund Management LLC: Omega Fund Management LLC-12.32%

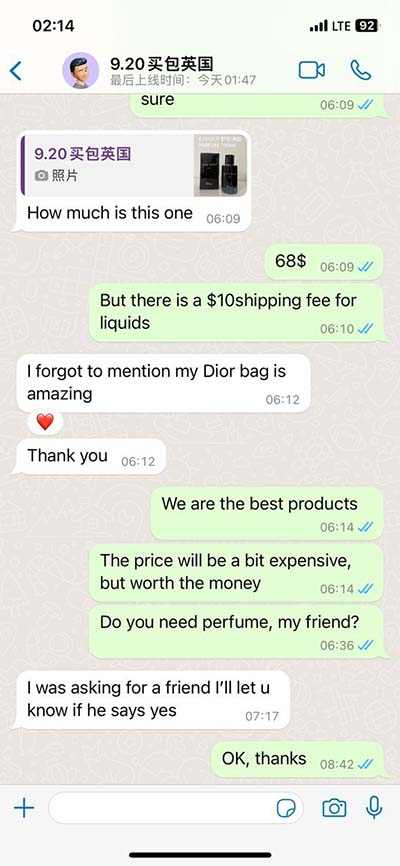

adidas balenciaga dupe

Miner: 68: The Ores Have it: Flower Girl: 4 Node Eval: Peaks: Best: Miner: 68: Mine All Mine: Miqote Fishing: 8 Node Eval: Peaks: Great: Miner: 68: Adios, Ala Mhigo: King: 32 or Fail: Peaks: OK

omega hedge fund|omega funds investment